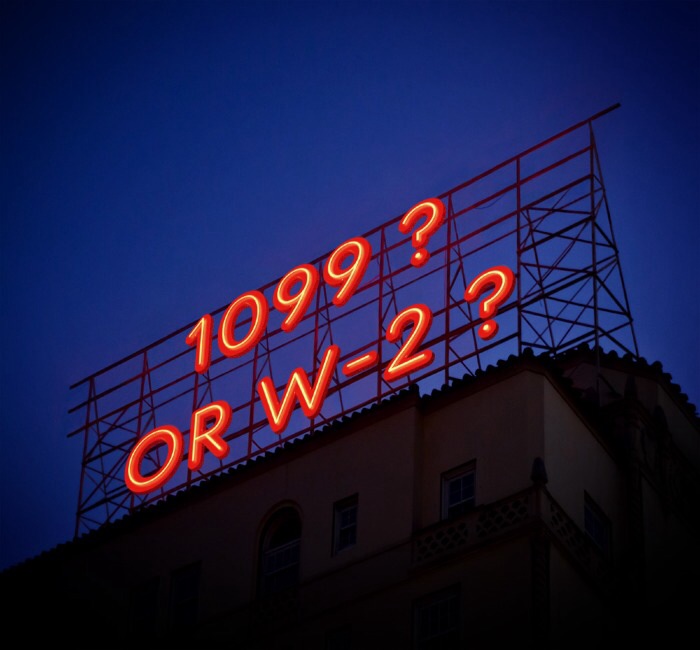

Here’s How to Avoid Self Employment Tax. Legally.

The IRS can take a big tax bite out of your small business bank account if you don’t pay attention to “Self Employment tax”. What is it? Self employment tax is how Uncle Sam collects Social Security and Medicare money from those who don’t have an employer deducting it from your paycheck. It’s included as […]

Here’s How to Avoid Self Employment Tax. Legally. Read More »