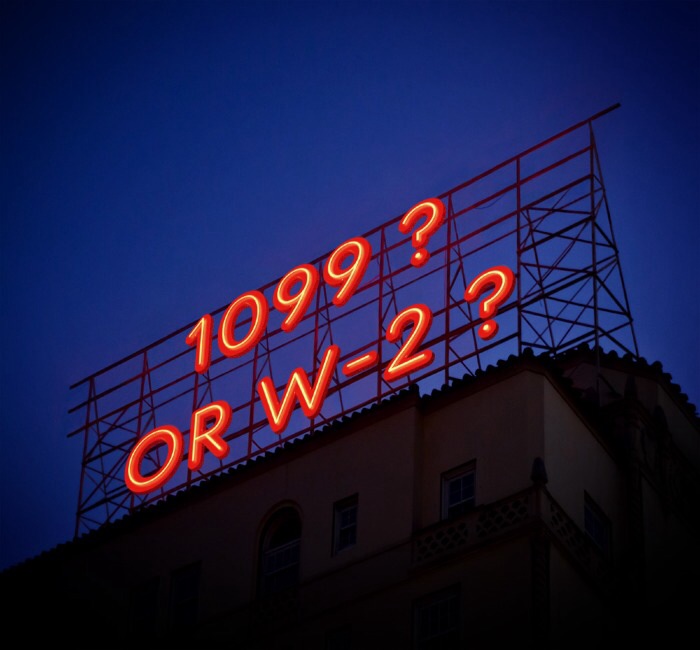

Is it OK to Pay Workers as 1099 Contractors?

Small business owners are always searching for ways to lower their taxes. One of the most common tactics is to classify workers as 1099 contractors, rather than as W-2 employees. When done within IRS guidelines, classifying a worker as an independent contractor will save your business a significant amount of money in payroll taxes and employee-related […]

Is it OK to Pay Workers as 1099 Contractors? Read More »